Our home PCs were hacked, network compromised. That has

been the reason I have been unable to post previously. The timing could not

have been any worse. The hacker wiped out all the data and program files on my

laptop. Metastock was not very cooperative. The technical people pointed me

towards sales. The sales person said he was very busy with the sales calls due

to Christmas and would call back… not really. And I am doing contract work in a

different State than we live in so I had to leave my laptop at home and stay

out of the markets while it roared upwards after the elections… this is one part

of trading’s mental things… the regret for not participating in a run up that

your system would be telling you to go into. Currently I have signed up for a

VPN service for protection. I am writing this blog from a hotel using the VPN. As I write this I cannot help but think that Cyber attack is very powerful and can be extremely painful..

Back to the blog…

The S&P500 (SPY) chart points up based on my trading

system. So is the Dow Jones 30. See charts for SPY and DIA. The ETF for the Dow Jones 30 is DIA. The US

Dollar is showing strength with the Fed’s interest rate increase. Gold funds

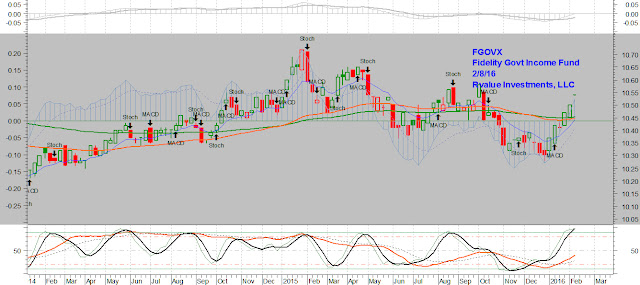

are down. The chart on the GLD ETF is falling hard and so are Bond funds – see chart

on FGOVX.

Going into one of my previous company’s 401K the top funds

selected by my monthly analysis are Royce Opportunity, Fidelity Equity Income,

Fidelity Freedom 2050 fund, Spartan 500 fund. Fidelity Govt Income Fund took a

big hit. Royce Opportunity requires a long stay in the fund due to the

redemption fee for getting out early. More in my next post.