The market remains in a downward position; but looking at

the chart below on SPY, I see that support is still holding. Support is the red

horizontal line. In fact the slow stochastics is showing an upward tilt. However

price is still below the blue line so our posture should be to look for trades

on the down side. See chart on SPY below.

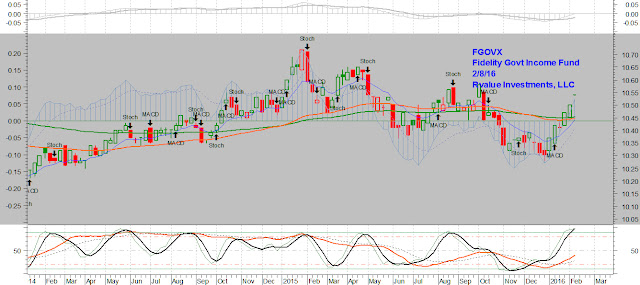

Interestingly the monthly 401K funds are decidedly negative.

This is demonstrated by my last employer’s 401K fund choices where the

preference is only to be in FGOVX which is the Fidelity Govt Income Fund, a

bond fund. See chart on FGOVX below. No other fund choices are recommended!

And in the 401K choices for another employer I was with, the

only two funds recommended are FGOVX and PIMCO GL BD ADM. None of the stock

funds are positive. So we sit and wait. No hurry to rush in.

I did dip my toes into the NUGT leveraged gold miner’s fund

at around $25 and got out this week at $37. Nice tidy profit in a week. But

caution – this ETF will move fast and can smack you. Today it dropped 11%. See chart below.

I have recently changed employer and taken a new job. What used to be my current employer's 401K funds has now become my last employer. And the employer before that I refer to as another employer. I cannot wait to start another 401K with my new, current employer.

No comments:

Post a Comment