The Santa Rally came in on time this year. It is now almost

the end of the year and time to ponder about what to expect next year, what mistakes

I have made and what I am going to do about it next year. One cannot change the

past. The only point in dwelling on the past is to prevent mistakes from

recurring.

After such a strong year, I expect we will have a modestly

positive next year in the 5-8% gain range. There has always been what is called

a reversion to the mean. When the value of SPY (S&P500 Exchange Traded

Fund) goes up and is 8-12% above its 200 day exponential moving average (ema)

it back peddles and gets back close to the 200 day ema. History shows that this

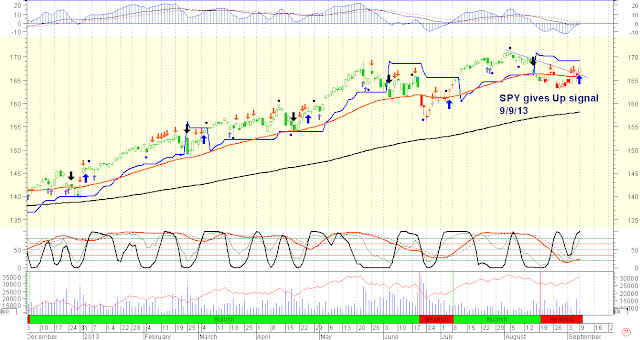

is 100% the case. See chart on SPY below. Once more I should point out that the Up arrow on the chart below signals long. The blue bubble signals an exit to the prior signal and reversing of direction. Therefore treat the blue bubble after a down arrow as a enter long signal in this trading system. The black line is the 200 day ema. During

down trends and when price drops below the 200 day ema it can go much further

down, as much as 40-45% below its 200 day ema but it too is eventually always mean

reversing. This does not mean the price will not rise once it goes up above

its 200 day ema substantially; but it does mean that it is likely to go

sideways and possibly pull back enough for the 200 day ema to catch up to it eventually. Regardless of the direction it goes, I need to rely on my own trading systems

for the signals which I post on this blog site. Follow the systems at your own peril!! I will.

My first New Years resolution in trading is not to listen

to others and instead follow my own trading systems.

That means I will not pick up newsletters from others as

this can create conflict. When my system says long and someone else says we are

in for a huge bear market, then it creates confusion for me that I do not need.

If my system says long then I will posture accordingly. I do not need someone

else to guess what is going to happen.

My second resolution is that I will add some aggressive

systems that will enable me to pick up higher gains.

My third resolution is that I will position for the down

side when I get an exit signal on SPY and look to breakeven or make a

little money when the market goes down. I will do that by buying negative ETFs

like SH or put options.

My fourth and final resolution is to develop an

aggressive Futures trading system that will generate a much greater than market

return. This will be my true ticket to independence if I can reach it.

Let us all hope to have a healthy and Happy New Year….