Markets Analysis: The markets have continued to move up in a

low interest rate environment and now fueled by the QE coming from Europe. My

stock chart on SPY (S&P 500) remains mysteriously pointing towards an exit

long signal while the markets have moved to new highs… The chart on QQQ shows

an Up signal. See charts below.

Looking at my past employer’s 401K the top performers that

the momentum method favors are Mt Vernon Growth, Cohen & Steers Realty and

Vanguard Instl Index funds. Next choice would be Artisan MidCap FD.

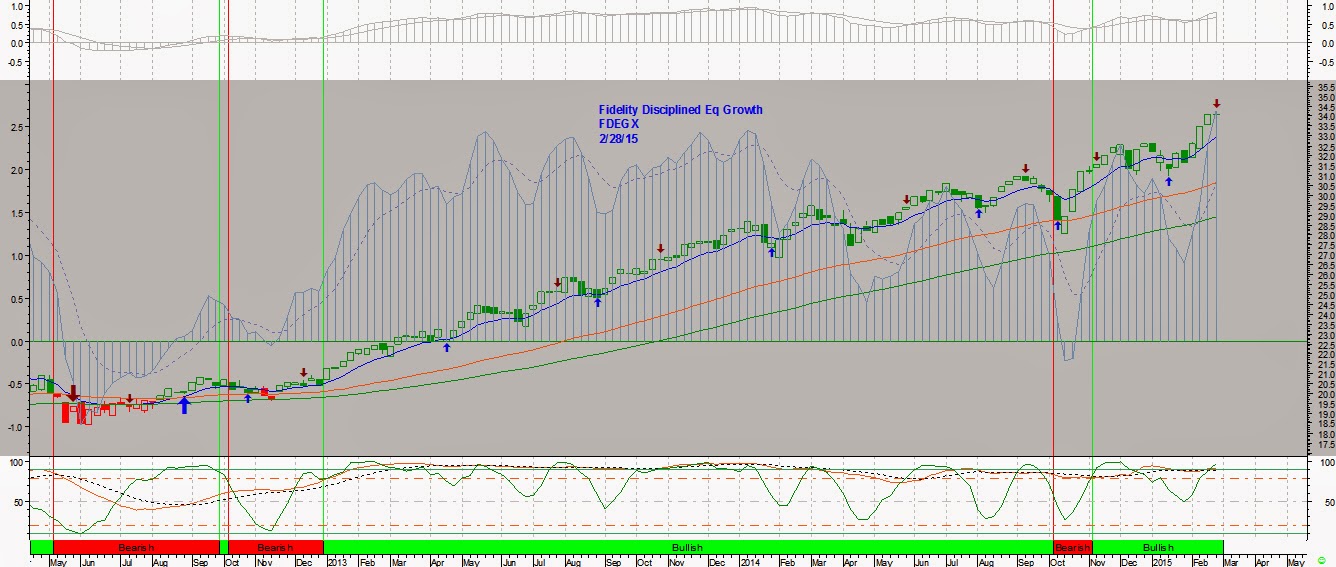

In my previous employers 401K funds the high performers are

Fidelity Growth Strategies, Spartan 500 Fund and Fidelity Fund. Fidelity Div Intl

has also broken out of its downward funk and is the 4th choice. The

chart below on Fidelity Growth Strategies shows a short term sell signal based

on being overbought. It has had a nice move up. The bottom of the barrel is

Royce Opportunities…which has not done well and is still in a consolidation

downwards...

No comments:

Post a Comment